Friday, 15 April 2011

Comparing Car Insurances

;

Two prominent types of car insurance are CTP or Compulsory Third Party and Comprehensive. As the word 'compulsory' is part of CTP you should know that it is insurance which is taken out when your car is registered. You have no choice but to pay for this cover; it is compulsory.

Comprehensive is the largest part of your car insurance and the one aspect in which companies can and do offer variation in their policies. The other types of non-compulsory car insurance are Third Party Fire and Theft and Third Party Property Damage. The first is to cover damage to or loss of your vehicle due to fire or theft and the property cover is to protect you should your vehicle cause damage to someone else's property.

Know too that most policies don't cover several things. You should ask to be sure before buying but usually your basic cover will not include wear and tear, damage to tyres when not in an accident and breakdowns.

Before choosing what you hope is the best deal, remember that cheapest doesn't always mean best. You need to consider a number of points including the age and cost of your vehicle, the amount of use, where the car is stored when not being driven, etc. Is your car vital to your employment? What is your age and driving record? These points help you decide the type of cover you need and certainly the risk insurers will take with you.

It's no good paying a low premium if you don't get the cover you require. Of course your budget restraints will need to be considered but make sure you have all the information at your fingertips before you start making comparisons.

Many people with car insurance receive their renewal policy every twelve months and pay the premium without thinking. They need insurance cover. But are they getting the best deal? Are they paying for cover they don't need? Are they not covered for an area they really do need?

The best advice is to use a free and independent company which can take your data and produce a number of quotes from a variety of car insurers. By simply providing the relevant facts about your vehicle and yourself, in no time at all you are given a comprehensive and personal report on what's available for you and your car regarding insurance. You would be mad not to take advantage of such a worthwhile and free service.

You can easily save many if you just compare car insurance quotes before finalizing your provider. This may be a very tricky thing in different conditions when you have your car lost or get accident unfortunately. But there are some companies offering best and still cheap car insurance quotes and you can make your decision without getting worry.

Comparing Car Insurances

The first thing to understand is the type of insurance you are seeking. Yes, there are different prices and shopping around or comparing is the best way to get the best deal. But beware comparing apples with oranges. You have to compare like with like. Because one policy is cheaper doesn't make it better. And the most important thing is to get the right cover for your car with you as its driver.Two prominent types of car insurance are CTP or Compulsory Third Party and Comprehensive. As the word 'compulsory' is part of CTP you should know that it is insurance which is taken out when your car is registered. You have no choice but to pay for this cover; it is compulsory.

Comprehensive is the largest part of your car insurance and the one aspect in which companies can and do offer variation in their policies. The other types of non-compulsory car insurance are Third Party Fire and Theft and Third Party Property Damage. The first is to cover damage to or loss of your vehicle due to fire or theft and the property cover is to protect you should your vehicle cause damage to someone else's property.

Know too that most policies don't cover several things. You should ask to be sure before buying but usually your basic cover will not include wear and tear, damage to tyres when not in an accident and breakdowns.

Before choosing what you hope is the best deal, remember that cheapest doesn't always mean best. You need to consider a number of points including the age and cost of your vehicle, the amount of use, where the car is stored when not being driven, etc. Is your car vital to your employment? What is your age and driving record? These points help you decide the type of cover you need and certainly the risk insurers will take with you.

It's no good paying a low premium if you don't get the cover you require. Of course your budget restraints will need to be considered but make sure you have all the information at your fingertips before you start making comparisons.

Many people with car insurance receive their renewal policy every twelve months and pay the premium without thinking. They need insurance cover. But are they getting the best deal? Are they paying for cover they don't need? Are they not covered for an area they really do need?

The best advice is to use a free and independent company which can take your data and produce a number of quotes from a variety of car insurers. By simply providing the relevant facts about your vehicle and yourself, in no time at all you are given a comprehensive and personal report on what's available for you and your car regarding insurance. You would be mad not to take advantage of such a worthwhile and free service.

You can easily save many if you just compare car insurance quotes before finalizing your provider. This may be a very tricky thing in different conditions when you have your car lost or get accident unfortunately. But there are some companies offering best and still cheap car insurance quotes and you can make your decision without getting worry.

Labels:

Insurance

Why Insurance Research Is Important Before Buying a Policy

;

When the time does come around though it is imperative to remember that it always pays to do your insurance research before going out into the market place to buy any of the different types of insurance policies that you may need.

One mistake that many people make is thinking that life insurance is just life insurance and health insurance is simply health insurance, as though they are just something sold generically. Sadly this is not the case and this is why it is smart to do your homework on the many types of insurance that you will find you need over time.

When you are getting life insurance there is not a standard policy that you and everyone else in the market can buy, there are a range of different policies with each one having it's own benefits and by doing the appropriate insurance research you will be able to ascertain which of these policies are suited to your individual needs.

In order to be able to successfully research insurance policies that you may need, it is important that you are aware of the following things:

* The type of insurance policy that you need - Is it health insurance or life insurance that you need? These are to name but a few categories of insurance that there are.

* Your budget - How much money can you afford to spend on an insurance premium each month/quarter/year?

* How long you need the cover for - Is it immediate short term cover or lasting long term cover?

* What you want from the insurance - For example with life insurance, do you want just cover against illness and death or an investment element as well?

The idea of taking the time to research insurance is not something that many people like the idea of, but here are a few reasons why it is well worth taking the time to do so:

* Save money - Like with anything you buy if you shop around you will get a better deal, insurance research may also point out that you perhaps need a cheaper policy than the one you first looked at.

* Save time - Without knowing exactly what you need you can spend a long time wondering which policy to buy, don't confuse this for shopping around, you may think that you need one thing but can't be sure that you don't need another until you have assessed all that is available.

* Save confusion - You have to know what is best for you as just because an insurer sells a policy, it does not mean that it is something that you need. Being sure will save confusion, no confusion will save you time and the combination of these will save you money, which is why insurance research is so important!

There is no need to make life difficult for yourself if you are a novice on insurance, as most people are. Insurance research can bring you a combination benefits and make life a lot easier for you and will save you time in the long run. If later down the line you do realise there was something more suited to your needs, or at a much more reasonable price elsewhere then you will be faced with the hassle of canceling and re-applying, this may sound simple but if your circumstances have changed since the first policy was taken out this can severely complicate matters.

Besides the wealth of information online and in company literature there is also help out there in the form of insurance agents. These agents work for the insurance companies and also on a freelance basis, and although it is very true to say that not everybody wants to ask for help, the assistance that they provide can be priceless. It really can pay to do the smart thing and research insurance before you buy it and asking for help could be one of the best financial decisions you ever make.

Steven D Wright worked for many years in the offices of one of the UK's largest insurance companies. His websites on Types of Business Insurance and types insurance policies explain in straight forward language the intricacies of the insurance world.

Why Insurance Research Is Important Before Buying a Policy

Many people think that insurance is a waste of money or only for those that are ultra-careful. Several more people, often those of a younger age, believe that they will never need insurance and the need to research insurance is something that will never be an issue for them. However, you can bet your bottom dollar that the time when insurance is required comes for all of us, whether that is when you get your first car maybe even a first mortgage to name just a couple of examples.When the time does come around though it is imperative to remember that it always pays to do your insurance research before going out into the market place to buy any of the different types of insurance policies that you may need.

One mistake that many people make is thinking that life insurance is just life insurance and health insurance is simply health insurance, as though they are just something sold generically. Sadly this is not the case and this is why it is smart to do your homework on the many types of insurance that you will find you need over time.

When you are getting life insurance there is not a standard policy that you and everyone else in the market can buy, there are a range of different policies with each one having it's own benefits and by doing the appropriate insurance research you will be able to ascertain which of these policies are suited to your individual needs.

In order to be able to successfully research insurance policies that you may need, it is important that you are aware of the following things:

* The type of insurance policy that you need - Is it health insurance or life insurance that you need? These are to name but a few categories of insurance that there are.

* Your budget - How much money can you afford to spend on an insurance premium each month/quarter/year?

* How long you need the cover for - Is it immediate short term cover or lasting long term cover?

* What you want from the insurance - For example with life insurance, do you want just cover against illness and death or an investment element as well?

The idea of taking the time to research insurance is not something that many people like the idea of, but here are a few reasons why it is well worth taking the time to do so:

* Save money - Like with anything you buy if you shop around you will get a better deal, insurance research may also point out that you perhaps need a cheaper policy than the one you first looked at.

* Save time - Without knowing exactly what you need you can spend a long time wondering which policy to buy, don't confuse this for shopping around, you may think that you need one thing but can't be sure that you don't need another until you have assessed all that is available.

* Save confusion - You have to know what is best for you as just because an insurer sells a policy, it does not mean that it is something that you need. Being sure will save confusion, no confusion will save you time and the combination of these will save you money, which is why insurance research is so important!

There is no need to make life difficult for yourself if you are a novice on insurance, as most people are. Insurance research can bring you a combination benefits and make life a lot easier for you and will save you time in the long run. If later down the line you do realise there was something more suited to your needs, or at a much more reasonable price elsewhere then you will be faced with the hassle of canceling and re-applying, this may sound simple but if your circumstances have changed since the first policy was taken out this can severely complicate matters.

Besides the wealth of information online and in company literature there is also help out there in the form of insurance agents. These agents work for the insurance companies and also on a freelance basis, and although it is very true to say that not everybody wants to ask for help, the assistance that they provide can be priceless. It really can pay to do the smart thing and research insurance before you buy it and asking for help could be one of the best financial decisions you ever make.

Steven D Wright worked for many years in the offices of one of the UK's largest insurance companies. His websites on Types of Business Insurance and types insurance policies explain in straight forward language the intricacies of the insurance world.

Labels:

Insurance

5 Tips for Buying Unemployment Insurance

;

Fortunately, help is at hand with unemployment cover insurance. This insurance provides for you in the event of a redundancy, keeping you afloat and preventing the walls of financial doom coming crashing down on top of you. Here are five top tips for finding the best unemployment insurance policy for you:

1. Do you have sufficient savings to support you and your family if you were to find yourself suddenly out of work? This one of the first questions you need to ask yourself when you are considering purchasing unemployment cover. The statistics suggest that most of us don't have enough money saved for a rainy day, and would struggle to sustain ourselves for any serious length of time between jobs.

Unfortunately, the gloomy economic climate means that you could very likely spend several months looking for a new job after being made redundant. A lot of businesses are currently reluctant to take on too many new employees when the future is so uncertain, and many government agencies have frozen their recruitment entirely. So with such limited opportunities on the job market it can take a while to get back into work, and if you don't have a significant pot of savings on standby for such an eventuality then you really ought to consider getting an unemployment insurance policy.

2. The key balancing act with unemployment insurance is finding a policy which provides comprehensive cover but does not charge you too much in your premiums each month. It is therefore vitally important that you consider your situation rationally and cover yourself only for what you need. Don't be tempted into taking as much cover as you can get if you don't actually need it, because the more unnecessary cover you take, the more you will have to pay for it in premiums.

3. Researching online is a great way to see what kind of unemployment cover deals are out there. A good way to start is with price comparison websites, which will be able to give you a good idea of what kind of premiums you are likely to pay for your chosen level of cover. Stick to the big comparison websites, as these will be the most trustworthy and have the most extensive listings of insurance firms.

4. You will find that the firms which offer the cheapest unemployment cover will tend to be particularly selective about who they agree to cover. If you are lucky enough to meet their discerning standards, then you have hit the unemployment insurance jackpot and can expect to pay much less than you would have to with other more mainstream providers.

The other side of this coin is that if your circumstances are not so favourable (for example if you work for a company that has begun to make redundancies), then you may find that only the most expensive insurance providers will agree to offer you cover. Good value unemployment insurance can be particularly hard to come by if you work in the civil service or in a particularly vulnerable industry such as construction.

5. Don't leave it too late to start an unemployment insurance policy. Insurers usually have an exclusion period of between 90 and 180 days from the start of your policy, which prevents you from claiming on the policy during this time. So if your firm has begun to make cutbacks and you expect to be next in the firing line, it may already be too late to open an unemployment insurance policy.

5 Tips for Buying Unemployment Insurance

As the UK economy lurches from bad to worse and the government cuts begin to bite, you can't help but feel no one's job is truly safe at the moment. This leaves us in a precarious position, as most of us rely on the monthly paycheck to cover the bills, rent, mortgage and other household expenses.Fortunately, help is at hand with unemployment cover insurance. This insurance provides for you in the event of a redundancy, keeping you afloat and preventing the walls of financial doom coming crashing down on top of you. Here are five top tips for finding the best unemployment insurance policy for you:

1. Do you have sufficient savings to support you and your family if you were to find yourself suddenly out of work? This one of the first questions you need to ask yourself when you are considering purchasing unemployment cover. The statistics suggest that most of us don't have enough money saved for a rainy day, and would struggle to sustain ourselves for any serious length of time between jobs.

Unfortunately, the gloomy economic climate means that you could very likely spend several months looking for a new job after being made redundant. A lot of businesses are currently reluctant to take on too many new employees when the future is so uncertain, and many government agencies have frozen their recruitment entirely. So with such limited opportunities on the job market it can take a while to get back into work, and if you don't have a significant pot of savings on standby for such an eventuality then you really ought to consider getting an unemployment insurance policy.

2. The key balancing act with unemployment insurance is finding a policy which provides comprehensive cover but does not charge you too much in your premiums each month. It is therefore vitally important that you consider your situation rationally and cover yourself only for what you need. Don't be tempted into taking as much cover as you can get if you don't actually need it, because the more unnecessary cover you take, the more you will have to pay for it in premiums.

3. Researching online is a great way to see what kind of unemployment cover deals are out there. A good way to start is with price comparison websites, which will be able to give you a good idea of what kind of premiums you are likely to pay for your chosen level of cover. Stick to the big comparison websites, as these will be the most trustworthy and have the most extensive listings of insurance firms.

4. You will find that the firms which offer the cheapest unemployment cover will tend to be particularly selective about who they agree to cover. If you are lucky enough to meet their discerning standards, then you have hit the unemployment insurance jackpot and can expect to pay much less than you would have to with other more mainstream providers.

The other side of this coin is that if your circumstances are not so favourable (for example if you work for a company that has begun to make redundancies), then you may find that only the most expensive insurance providers will agree to offer you cover. Good value unemployment insurance can be particularly hard to come by if you work in the civil service or in a particularly vulnerable industry such as construction.

5. Don't leave it too late to start an unemployment insurance policy. Insurers usually have an exclusion period of between 90 and 180 days from the start of your policy, which prevents you from claiming on the policy during this time. So if your firm has begun to make cutbacks and you expect to be next in the firing line, it may already be too late to open an unemployment insurance policy.

Labels:

Insurance

Trauma Cover Versus Life Insurance

;

Insurance is one of the best ways to protect yourself against the unexpected. Whether it be travel insurance, car insurance, home and contents, health insurance or something else, these policies can be taken out to help support you when there is a problem. For example, if you have a car accident and your vehicle is wrecked, your insurance will pay (after the excess) to cover the damage. By having thousands of people like yourself purchasing insurance, they can let you "split the costs" for the people who do run into trouble.

The majority of people who take out insurance never need it, but the money invested is a small price to pay for the peace of mind, knowing you will be protected should a problem arise. But for each type of insurance, there are a range of different covers, and certain clauses that you need to be made aware of. There's no point taking out a policy and paying money each money if it doesn't cover you for what you're

expecting.

One such type that springs to mind is life insurance. A large number of people wrongly assume that life insurance will cover them if they have an accident or get diagnosed with a terminal illness. However this is just not the case. Life insurance policies are only paid out when the policy holder dies. So in effect, this insurance is taken out to protect a person's family, not to assist in any types of payments if you get sick or have a serious accident.

This can be a serious problem, because many people want to not only protect their family from any unforeseen tragedies, but also want to protect themselves if they have a major accident or contract a terminal illness. This is where trauma cover comes in. Unlike life insurance, for people with a trauma insurance policy can receive a full lump sum payout if they have an major accident or suffer a serious illness. Once the insurance company assesses the persons claim, once approved, they will receive the money immediately.

The amount paid out is agreed upon when you first take out the policy, and the payout that you want will determine how much your monthly insurance payments are. Typically $250,000 can be a standard amount. This can be very helpful to assist you with any major expenses including hospital bills, in the short term and potentially ongoing, and any other medical fees that may be incurred. You can also use the money to make mortgage repayments, so if you're no longer able to work, you can still pay bills and keep your finances under control.

Protecting yourself and your family against nasty surprises is something that everyone needs to consider. And knowing the difference between various types of insurance can go a long way to make sure you're actually covered for what you think.

Elliot Dean provides information on the benefits of trauma cover to protect individuals and families against unexpected occurrences.

Trauma Cover Versus Life Insurance

Insurance is one of the best ways to protect yourself against the unexpected. Whether it be travel insurance, car insurance, home and contents, health insurance or something else, these policies can be taken out to help support you when there is a problem. For example, if you have a car accident and your vehicle is wrecked, your insurance will pay (after the excess) to cover the damage. By having thousands of people like yourself purchasing insurance, they can let you "split the costs" for the people who do run into trouble.

The majority of people who take out insurance never need it, but the money invested is a small price to pay for the peace of mind, knowing you will be protected should a problem arise. But for each type of insurance, there are a range of different covers, and certain clauses that you need to be made aware of. There's no point taking out a policy and paying money each money if it doesn't cover you for what you're

expecting.

One such type that springs to mind is life insurance. A large number of people wrongly assume that life insurance will cover them if they have an accident or get diagnosed with a terminal illness. However this is just not the case. Life insurance policies are only paid out when the policy holder dies. So in effect, this insurance is taken out to protect a person's family, not to assist in any types of payments if you get sick or have a serious accident.

This can be a serious problem, because many people want to not only protect their family from any unforeseen tragedies, but also want to protect themselves if they have a major accident or contract a terminal illness. This is where trauma cover comes in. Unlike life insurance, for people with a trauma insurance policy can receive a full lump sum payout if they have an major accident or suffer a serious illness. Once the insurance company assesses the persons claim, once approved, they will receive the money immediately.

The amount paid out is agreed upon when you first take out the policy, and the payout that you want will determine how much your monthly insurance payments are. Typically $250,000 can be a standard amount. This can be very helpful to assist you with any major expenses including hospital bills, in the short term and potentially ongoing, and any other medical fees that may be incurred. You can also use the money to make mortgage repayments, so if you're no longer able to work, you can still pay bills and keep your finances under control.

Protecting yourself and your family against nasty surprises is something that everyone needs to consider. And knowing the difference between various types of insurance can go a long way to make sure you're actually covered for what you think.

Elliot Dean provides information on the benefits of trauma cover to protect individuals and families against unexpected occurrences.

Labels:

Insurance

How to Begin the Process of PPI Claims

;

The first thing that you have to know is the fact that you may have been mis-sold payment protection insurance in the past on another loan. There are over 20 million PPI policies held in the United Kingdom and many of those had been sold alongside loans, credit card, store cards, mortgages along with types of loans. A lot of consumer support group feel that around two million of these policies have already been mis-sold since year 2003 and you could very well be an owner of one of them. To see if you've got PPI claims start out the process of getting back your money.

After you take a new line of credit, a loan, a credit card, a store card, car finance or mortgage you might be often usually offered to take out PPI also to cover the repayments of your loan when you are struggling to do so, like when you fall into severe illness, accident or loss of employment. However, several policyholders have found out that they have been not able to help make PPI claims since the sales representative didn't point out that there are exclusions that could stop them from making PPI claims. Many banks and lending companies or credit companies neglected to point out these types of exclusions resulting in potentially millions of worthless and expensive mis-sold payment protection insurance agreements.

In some instances, policies were incorporated on to the loan without the permission or knowledge of the customer and in other instances, sales representatives of banks and lending companies informed the borrowers that they would get the loan only if they took out the policy. If you were not aware of the exclusions at the time of the purchase, you might be paying or have paid for a policy that you cannot benefit from. Two of the classic exclusions that were not highlighted by the sales representative are merely cover full time employees and doesn't cover a person after they reach the age of retirement.

Harry Tomas specialises in PPI claims and other financial products for British based business www.PPIClaimsUK.co.uk. He also covers unfair credit card charges and the financial claims sector generally, in addition to writing articles on personal finance, house sales, repossession and business finance.

How to Begin the Process of PPI Claims

Probably, you already know a little information about payment protection insurance or PPI. However, if you are considering purchasing PPI or creating PPI claims it's always a good idea to get more information and details on this kind of insurance policy. To assist you in making an informed decision, read some of the important matters to consider before you make any commitment to a policy or PPI claims procedure.The first thing that you have to know is the fact that you may have been mis-sold payment protection insurance in the past on another loan. There are over 20 million PPI policies held in the United Kingdom and many of those had been sold alongside loans, credit card, store cards, mortgages along with types of loans. A lot of consumer support group feel that around two million of these policies have already been mis-sold since year 2003 and you could very well be an owner of one of them. To see if you've got PPI claims start out the process of getting back your money.

After you take a new line of credit, a loan, a credit card, a store card, car finance or mortgage you might be often usually offered to take out PPI also to cover the repayments of your loan when you are struggling to do so, like when you fall into severe illness, accident or loss of employment. However, several policyholders have found out that they have been not able to help make PPI claims since the sales representative didn't point out that there are exclusions that could stop them from making PPI claims. Many banks and lending companies or credit companies neglected to point out these types of exclusions resulting in potentially millions of worthless and expensive mis-sold payment protection insurance agreements.

In some instances, policies were incorporated on to the loan without the permission or knowledge of the customer and in other instances, sales representatives of banks and lending companies informed the borrowers that they would get the loan only if they took out the policy. If you were not aware of the exclusions at the time of the purchase, you might be paying or have paid for a policy that you cannot benefit from. Two of the classic exclusions that were not highlighted by the sales representative are merely cover full time employees and doesn't cover a person after they reach the age of retirement.

Harry Tomas specialises in PPI claims and other financial products for British based business www.PPIClaimsUK.co.uk. He also covers unfair credit card charges and the financial claims sector generally, in addition to writing articles on personal finance, house sales, repossession and business finance.

Labels:

Insurance

An Overview of Best Term Insurance and Its Benefits

;

If you have family and dependents then the term insurance is the must for you. No other policy will offer you as much as value for your money than this. For example let us consider a situation, if something unfortunate happens to you who will take care of your family? This question may bother you; if it tends to happen, then best life insurance is the answer. If something happens to you one day then your family will be fortunate by a certain amount, to maintain their lifestyle. Surveys in a well know newspaper said that life coverage should be worth 6-7 times of your current annual income.

Best term insurance is indeed a term life insurance which charges the lowest term insurance premium but also the term insurance plans gives maximum coverage as well. There are various term insurance companies in market. The premium for this may vary depending on your age and the time period. The term plan is also called a protection plan. Best term insurance is the cheapest insurance policy. This is suitable to you if you're looking to insure your life at minimum cost of premium. One should consider taking term life insurance at an early age, since the earlier you take it the lower the premium is.

Best term insurance is cheap, so everyone can consider taking it regardless of their age, sex and occupation. You can find about different insurance policies on many comparison sites. In the term plan you can get a huge life coverage with a nominal premium amount. Best term insurance is a hassle free claim settlement as well. It's good when we talk about the advantages and need of an insurance, but one of the most important things to consider is the getting the plan from one of the trustworthy company. There are different ratings and financial standings for each company. So make your choice with a good company.

The author has written several articles on the topic best term insurance. He also has experience in the field of insurance and educates people on the necessity of insurance to make their life secure.

An Overview of Best Term Insurance and Its Benefits

Life is full of uncertainties and risk; anything may happen at any time to anyone. So an insurance policy is a must. Modern day investments include gold, property, mutual funds and of course the life insurance. Investing your hard-earned money in a secure way in life insurance is the best choice to safeguard your family's future life. There are a lot of options to save money but among all of the options life insurance is the best because it not only save your money but also it makes sure that future life is secure in their hands. In simple words if we say, life insurance plays a dual role in your life, saving for life's important goal and saving your assets.If you have family and dependents then the term insurance is the must for you. No other policy will offer you as much as value for your money than this. For example let us consider a situation, if something unfortunate happens to you who will take care of your family? This question may bother you; if it tends to happen, then best life insurance is the answer. If something happens to you one day then your family will be fortunate by a certain amount, to maintain their lifestyle. Surveys in a well know newspaper said that life coverage should be worth 6-7 times of your current annual income.

Best term insurance is indeed a term life insurance which charges the lowest term insurance premium but also the term insurance plans gives maximum coverage as well. There are various term insurance companies in market. The premium for this may vary depending on your age and the time period. The term plan is also called a protection plan. Best term insurance is the cheapest insurance policy. This is suitable to you if you're looking to insure your life at minimum cost of premium. One should consider taking term life insurance at an early age, since the earlier you take it the lower the premium is.

Best term insurance is cheap, so everyone can consider taking it regardless of their age, sex and occupation. You can find about different insurance policies on many comparison sites. In the term plan you can get a huge life coverage with a nominal premium amount. Best term insurance is a hassle free claim settlement as well. It's good when we talk about the advantages and need of an insurance, but one of the most important things to consider is the getting the plan from one of the trustworthy company. There are different ratings and financial standings for each company. So make your choice with a good company.

The author has written several articles on the topic best term insurance. He also has experience in the field of insurance and educates people on the necessity of insurance to make their life secure.

Labels:

Insurance

The Benefits Of Having Boat Liability Insurance Today

;

If you are looking for the best protection when you are a boat owner then carrying liability coverage is key. This is since it protects you and the property you own, and replaces it in the case of total loss or damage from: fire, theft, vandalism, collision, storms, and collision. This way you get the protection you need, and don't have to worry so much when something happens.

Basically, there are two types of coverage today. There's actual cash value which means the value is assessed at the time of loss, then you are paid what the current market value is. The other kind is based on an agree amount. This is a set amount that was agree upon in the even of a loss. It covers only a set amount. Each one has their own benefits and advantages, so it's a wise to see which is best for you.

Boat insurance is made easy with the web. Not only can you find a local insurer, but get an online quote in minutes. This way you are able to get a good idea of what to expect and you're able to find what's best for you and your boating needs.

For anybody in the market for boat insurance then it's a wise choice to find a local agent you can trust. This can be done with the web in just a few minutes to see who is in your area. When you do you are able to contact an agent close to you to find the exactly what you need for all your boating needs.

One thing is going to go a long way is when getting an insurance policy honesty is key. This means don't try to list your property as valued higher than it actually is. If you do this and something happens, they can end up paying much less and canceling your policy.

To protect what matters most a boat insurance policy is important to give you peace of mind. It can replace property and even the boat it self whenever there is total loss, damage from a storm, lightning, wind and more. Two main kinds of coverage are: actual cash value and another that's called value assessed. When you are shopping around do make sure to find out the difference by asking your agent. Shopping around and getting the right help is going to go a long way in saving money and finding the best deal.

The Benefits Of Having Boat Liability Insurance Today

Today if you are a boat owner it's a good idea to have boat liability insurance. It not only protects you against theft, damage and various other things, it's important for peace of mind. Two types of coverage to familiarize yourself with are: Actual cash value and assessed value. Each has their own benefits when compared to each other so knowing which is best is important. Finding and buying a policy is a snap with the help of the web and a local agent, and gets you the coverage you need.If you are looking for the best protection when you are a boat owner then carrying liability coverage is key. This is since it protects you and the property you own, and replaces it in the case of total loss or damage from: fire, theft, vandalism, collision, storms, and collision. This way you get the protection you need, and don't have to worry so much when something happens.

Basically, there are two types of coverage today. There's actual cash value which means the value is assessed at the time of loss, then you are paid what the current market value is. The other kind is based on an agree amount. This is a set amount that was agree upon in the even of a loss. It covers only a set amount. Each one has their own benefits and advantages, so it's a wise to see which is best for you.

Boat insurance is made easy with the web. Not only can you find a local insurer, but get an online quote in minutes. This way you are able to get a good idea of what to expect and you're able to find what's best for you and your boating needs.

For anybody in the market for boat insurance then it's a wise choice to find a local agent you can trust. This can be done with the web in just a few minutes to see who is in your area. When you do you are able to contact an agent close to you to find the exactly what you need for all your boating needs.

One thing is going to go a long way is when getting an insurance policy honesty is key. This means don't try to list your property as valued higher than it actually is. If you do this and something happens, they can end up paying much less and canceling your policy.

To protect what matters most a boat insurance policy is important to give you peace of mind. It can replace property and even the boat it self whenever there is total loss, damage from a storm, lightning, wind and more. Two main kinds of coverage are: actual cash value and another that's called value assessed. When you are shopping around do make sure to find out the difference by asking your agent. Shopping around and getting the right help is going to go a long way in saving money and finding the best deal.

Labels:

Insurance

How an Insurance Policy Works

;

For example, if Mr. Adam buys a new car and wishes to insure the vehicle against any expected accidents. He will buy an insurance policy from an insurance company through an insurance agent or insurance broker by paying a specific amount of money, called premium, to the insurance company.

The moment Mr. Adam pay the premium, the insurer (i.e. the insurance company) issue an insurance policy, or contract paper, to him. In this policy, the insurer analyses how it will pay for all or part of the damages/losses that may occur on Mr. Adam's car.

However, just as Mr. Adam is able to buy an insurance policy and is paying to his insurer, a lot of other people in thousands are also doing the same thing. Any one of these people who are insured by the insurer is referred to as insured. Normally, most of these people will never have any form of accidents and hence there will be no need for the insurer to pay them any form of compensation.

If Mr. Adam and a very few other people has any form of accidents/losses, the insurer will pay them based on their policy.

It should be noted that the entire premiums paid by these thousands of insured is so much more than the compensations to the damages/losses incurred by some few insured. Hence, the huge left-over money (from the premiums collected after paying the compensations) is utilized by the insurer as follows:

1. Some are kept as a cash reservoir.

2. Some are used as investments for more profit.

3. Some are used as operating expenses in form of rent, supplies, salaries, staff welfare etc.

4. Some are lent out to banks as fixed deposits for more profit etc. etc.

Apart from the vehicle insurance taken by Mr. Adam on his new vehicle, he can also decide to insure himself. This one is extremely different because it involves a human life and is thus termed Life Insurance or Assurance.

Life insurance (or assurance) is the insurance against against certainty or something that is certain to happen such as death, rather than something that might happen such as loss of or damage to property.

The issue of life insurance is a paramount one because it concerns the security of human life and business. Life insurance offers real protection for your business and it also provides some sot of motivation for any skilled employees who decides to to join your organization.

Life insurance insures the life of the policy holder and pays a benefit to the beneficiary. This beneficiary can be your business in the case of a key employee, partner, or co-owner. In some cases, the beneficiary may be one's next of kin or a near or distant relation. The beneficiary is not limited to one person; it depends on the policy holder.

Life insurance policies exist in three forms:

• Whole life insurance

• Term Insurance

• Endowment insurance

• Whole Life Insurance

In Whole Life Insurance (or Whole Assurance), the insurance company pays an agreed sum of money (i.e. sum assured) upon the death of the person whose life is insured. As against the logic of term life insurance, Whole Life Insurance is valid and it continues in existence as long as the premiums of the policy holders are paid.

When a person express his wish in taking a Whole Life Insurance, the insurer will look at the person's current age and health status and use this data to reviews longevity charts which predict the person's life duration/life-span. The insurer then present a monthly/quarterly/bi-annual/annual level premium. This premium to be paid depends on a person's present age: the younger the person the higher the premium and the older the person the lower the premium. However, the extreme high premium being paid by a younger person will reduce gradually relatively with age over the course of many years.

In case you are planning a life insurance, the insurer is in the best position to advise you on the type you should take. Whole life insurance exists in three varieties, as follow: variable life, universal life, and variable-universal life; and these are very good options for your employees to consider or in your personal financial plan.

Term Insurance

In Term Insurance, the life of the policy-holder is insured for a specific period of time and if the person dies within the period the insurance company pays the beneficiary. Otherwise, if the policy-holder lives longer than the period of time stated in the policy, the policy is no longer valid. In a simple word, if death does not occur within stipulated period, the policy-holder receives nothing.

For example, Mr. Adam takes a life policy for a period of not later than the age of 60. If Mr. Adam dies within the age of less than 60 years, the insurance company will pay the sum assured. If Mr. Adam's death does not occur within the stated period in the life policy (i.e. Mr. Adam lives up to 61 years and above), the insurance company pays nothing no matter the premiums paid over the term of the policy.

Term assurance will pay the policy holder only if death occurs during the "term" of the policy, which can be up to 30 years. Beyond the "term", the policy is null and void (i.e. worthless). Term life insurance policies are basically of two types:

o Level term: In this one, the death benefit remains constant throughout the duration of the policy.

o Decreasing term: Here, the death benefit decreases as the course of the policy's term progresses.

It should be note that Term Life Insurance can be used in a debtor-creditor scenario. A creditor may decide to insure the life of his debtor for a period over which the debt repayment is expected to be completed, so that if the debtor dies within this period, the creditor (being the policy-holder) gets paid by the insurance company for the sum assured).

Endowment Life Insurance

In Endowment Life Insurance, the life of the policy holder is insured for a specific period of time (say, 30 years) and if the person insured is still alive after the policy has timed out, the insurance company pays the policy-holder the sum assured. However, if the person assured dies within the "time specified" the insurance company pays the beneficiary.

For example, Mr. Adam took an Endowment Life Insurance for 35 years when he was 25 years of age. If Mr. Adam is lucky to attain the age of 60 (i.e. 25 + 35), the insurance company will pay the policy-holder (i.e. whoever is paying the premium, probably Mr. Adam if he is the one paying the premium) the sum assured. However, if Mr. Adam dies at the age of 59 years before completing the assured time of 35 years, his sum assured will be paid to his beneficiary (i.e. policy-holder). In case of death, the sum assured is paid at the age which Mr. Adam dies.

David Mog is the owner of the blog http://insurancefarmland.blogspot.com/ and he is giving you as a reader the right to use this writeup as you deem fit in your research work on the basis that the blog link and the contents will not be tampered with but will remain as it is without being edited.

I am a Mathematician by profession. I studied in Ontario, Canada. For the past 15 years, I've been almost all over the globe in my consultancy jobs.

I specialize in Research & Development that deals with the design of computer programs in solving a specific problems.

Specifically, I was one-time an Insurance Salesman before I went for my college education. So, all the pros and cons of Insurance world are well known to me like the lines on my palms.

I've been to Japan, South Korea, Australia, England, Netherlands, South Africa, Egypt, just to mention a few.

Right now, I have a current project I'm handling in Ghana, where I am presently staying.

How an Insurance Policy Works

Insurance is synonymous to a lot of people sharing risks of losses expected from a supposed accident. Here, the costs of the losses will be borne by all the insurers.For example, if Mr. Adam buys a new car and wishes to insure the vehicle against any expected accidents. He will buy an insurance policy from an insurance company through an insurance agent or insurance broker by paying a specific amount of money, called premium, to the insurance company.

The moment Mr. Adam pay the premium, the insurer (i.e. the insurance company) issue an insurance policy, or contract paper, to him. In this policy, the insurer analyses how it will pay for all or part of the damages/losses that may occur on Mr. Adam's car.

However, just as Mr. Adam is able to buy an insurance policy and is paying to his insurer, a lot of other people in thousands are also doing the same thing. Any one of these people who are insured by the insurer is referred to as insured. Normally, most of these people will never have any form of accidents and hence there will be no need for the insurer to pay them any form of compensation.

If Mr. Adam and a very few other people has any form of accidents/losses, the insurer will pay them based on their policy.

It should be noted that the entire premiums paid by these thousands of insured is so much more than the compensations to the damages/losses incurred by some few insured. Hence, the huge left-over money (from the premiums collected after paying the compensations) is utilized by the insurer as follows:

1. Some are kept as a cash reservoir.

2. Some are used as investments for more profit.

3. Some are used as operating expenses in form of rent, supplies, salaries, staff welfare etc.

4. Some are lent out to banks as fixed deposits for more profit etc. etc.

Apart from the vehicle insurance taken by Mr. Adam on his new vehicle, he can also decide to insure himself. This one is extremely different because it involves a human life and is thus termed Life Insurance or Assurance.

Life insurance (or assurance) is the insurance against against certainty or something that is certain to happen such as death, rather than something that might happen such as loss of or damage to property.

The issue of life insurance is a paramount one because it concerns the security of human life and business. Life insurance offers real protection for your business and it also provides some sot of motivation for any skilled employees who decides to to join your organization.

Life insurance insures the life of the policy holder and pays a benefit to the beneficiary. This beneficiary can be your business in the case of a key employee, partner, or co-owner. In some cases, the beneficiary may be one's next of kin or a near or distant relation. The beneficiary is not limited to one person; it depends on the policy holder.

Life insurance policies exist in three forms:

• Whole life insurance

• Term Insurance

• Endowment insurance

• Whole Life Insurance

In Whole Life Insurance (or Whole Assurance), the insurance company pays an agreed sum of money (i.e. sum assured) upon the death of the person whose life is insured. As against the logic of term life insurance, Whole Life Insurance is valid and it continues in existence as long as the premiums of the policy holders are paid.

When a person express his wish in taking a Whole Life Insurance, the insurer will look at the person's current age and health status and use this data to reviews longevity charts which predict the person's life duration/life-span. The insurer then present a monthly/quarterly/bi-annual/annual level premium. This premium to be paid depends on a person's present age: the younger the person the higher the premium and the older the person the lower the premium. However, the extreme high premium being paid by a younger person will reduce gradually relatively with age over the course of many years.

In case you are planning a life insurance, the insurer is in the best position to advise you on the type you should take. Whole life insurance exists in three varieties, as follow: variable life, universal life, and variable-universal life; and these are very good options for your employees to consider or in your personal financial plan.

Term Insurance

In Term Insurance, the life of the policy-holder is insured for a specific period of time and if the person dies within the period the insurance company pays the beneficiary. Otherwise, if the policy-holder lives longer than the period of time stated in the policy, the policy is no longer valid. In a simple word, if death does not occur within stipulated period, the policy-holder receives nothing.

For example, Mr. Adam takes a life policy for a period of not later than the age of 60. If Mr. Adam dies within the age of less than 60 years, the insurance company will pay the sum assured. If Mr. Adam's death does not occur within the stated period in the life policy (i.e. Mr. Adam lives up to 61 years and above), the insurance company pays nothing no matter the premiums paid over the term of the policy.

Term assurance will pay the policy holder only if death occurs during the "term" of the policy, which can be up to 30 years. Beyond the "term", the policy is null and void (i.e. worthless). Term life insurance policies are basically of two types:

o Level term: In this one, the death benefit remains constant throughout the duration of the policy.

o Decreasing term: Here, the death benefit decreases as the course of the policy's term progresses.

It should be note that Term Life Insurance can be used in a debtor-creditor scenario. A creditor may decide to insure the life of his debtor for a period over which the debt repayment is expected to be completed, so that if the debtor dies within this period, the creditor (being the policy-holder) gets paid by the insurance company for the sum assured).

Endowment Life Insurance

In Endowment Life Insurance, the life of the policy holder is insured for a specific period of time (say, 30 years) and if the person insured is still alive after the policy has timed out, the insurance company pays the policy-holder the sum assured. However, if the person assured dies within the "time specified" the insurance company pays the beneficiary.

For example, Mr. Adam took an Endowment Life Insurance for 35 years when he was 25 years of age. If Mr. Adam is lucky to attain the age of 60 (i.e. 25 + 35), the insurance company will pay the policy-holder (i.e. whoever is paying the premium, probably Mr. Adam if he is the one paying the premium) the sum assured. However, if Mr. Adam dies at the age of 59 years before completing the assured time of 35 years, his sum assured will be paid to his beneficiary (i.e. policy-holder). In case of death, the sum assured is paid at the age which Mr. Adam dies.

David Mog is the owner of the blog http://insurancefarmland.blogspot.com/ and he is giving you as a reader the right to use this writeup as you deem fit in your research work on the basis that the blog link and the contents will not be tampered with but will remain as it is without being edited.

I am a Mathematician by profession. I studied in Ontario, Canada. For the past 15 years, I've been almost all over the globe in my consultancy jobs.

I specialize in Research & Development that deals with the design of computer programs in solving a specific problems.

Specifically, I was one-time an Insurance Salesman before I went for my college education. So, all the pros and cons of Insurance world are well known to me like the lines on my palms.

I've been to Japan, South Korea, Australia, England, Netherlands, South Africa, Egypt, just to mention a few.

Right now, I have a current project I'm handling in Ghana, where I am presently staying.

Labels:

Insurance

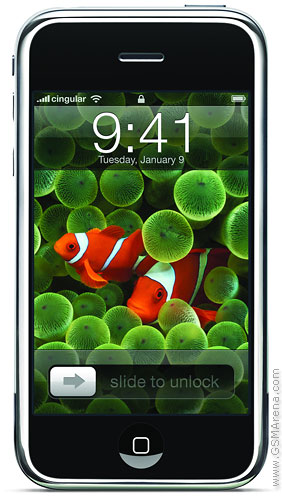

Apple iPhone

;

Apple iPhone

Features

| General | 2G Network | GSM 850 / 900 / 1800 / 1900 |

|---|---|---|

| Announced | 2007, January. Released 2007, June | |

| Status | Discontinued |

| Size | Dimensions | 115 x 61 x 11.6 mm |

|---|---|---|

| Weight | 135 g |

| Display | Type | TFT capacitive touchscreen, 16M colors |

|---|---|---|

| Size | 320 x 480 pixels, 3.5 inches | |

| - Multi-touch input method - Accelerometer sensor for auto-rotate - Proximity sensor for auto turn-off - Scratch-resistant surface |

| Sound | Alert types | Vibration; Downloadable polyphonic, MP3 ringtones |

|---|---|---|

| Loudspeaker | Yes | |

| 3.5mm jack | Yes |

| Memory | Phonebook | Practically unlimited entries and fields, Photocall |

|---|---|---|

| Call records | 100 received, dialed and missed calls | |

| Internal | 4/8/16 GB | |

| Card slot | No |

| Data | GPRS | Yes |

|---|---|---|

| EDGE | Yes | |

| 3G | No | |

| WLAN | Wi-Fi 802.11b/g | |

| Bluetooth | Yes, v2.0, headset support only | |

| Infrared port | No | |

| USB | Yes, v2.0 |

| Camera | Primary | 2 MP, 1600x1200 pixels |

|---|---|---|

| Video | No | |

| Secondary | No |

| Features | OS | iPhone OS |

|---|---|---|

| CPU | ARM 11 412 MHz, PowerVR MBX-Lite graphics | |

| Messaging | SMS (threaded view), Email | |

| Browser | HTML (Safari) | |

| Radio | No | |

| Games | Downloadable, incl. motion-based | |

| Colors | Black | |

| GPS | No | |

| Java | No | |

| - Google Maps - Audio/video player - TV-out |

| Battery | Standard battery, Li-Ion | |

|---|---|---|

| Stand-by | Up to 250 h | |

| Talk time | Up to 8 h | |

| Music play | Up to 24 h |

| Misc | SAR US | 0.97 W/kg (head) 0.38 W/kg (body) |

|---|---|---|

| SAR EU | 0.97 W/kg (head) 0.69 W/kg (body) |

Labels:

Mobiles

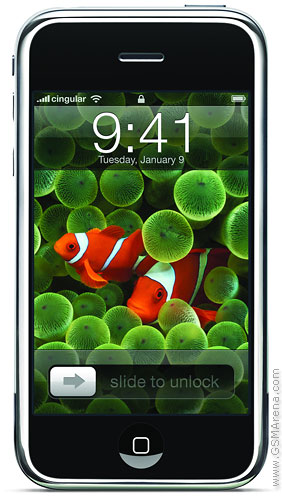

Apple iPhone 3G

;

Apple iPhone 3G

Features

| General | 2G Network | GSM 850 / 900 / 1800 / 1900 |

|---|---|---|

| 3G Network | HSDPA 850 / 1900 / 2100 | |

| Announced | 2008, June. Released 2008, July | |

| Status | Discontinued |

| Size | Dimensions | 115.5 x 62.1 x 12.3 mm |

|---|---|---|

| Weight | 133 g |

| Display | Type | TFT capacitive touchscreen, 16M colors |

|---|---|---|

| Size | 320 x 480 pixels, 3.5 inches | |

| - Multi-touch input method - Accelerometer sensor for auto-rotate - Proximity sensor for auto turn-off - Scratch-resistant surface |

| Sound | Alert types | Vibration, MP3 ringtones |

|---|---|---|

| Loudspeaker | Yes | |

| 3.5mm jack | Yes, check quality |

| Memory | Phonebook | Practically unlimited entries and fields, Photocall |

|---|---|---|

| Call records | 100 received, dialed and missed calls | |

| Internal | 8 GB/ 16 GB storage, 128 MB RAM | |

| Card slot | No |

| Data | GPRS | Yes |

|---|---|---|

| EDGE | Yes | |

| 3G | HSDPA | |

| WLAN | Wi-Fi 802.11b/g | |

| Bluetooth | Yes, v2.0 with A2DP, headset support only | |

| Infrared port | No | |

| USB | Yes, v2.0 |

| Camera | Primary | 2 MP, 1600x1200 pixels |

|---|---|---|

| Video | No | |

| Secondary | No |

| Features | OS | iPhone OS, upgradable to iOS 4 |

|---|---|---|

| CPU | ARM 11 412 MHz, PowerVR MBX-Lite graphics | |

| Messaging | SMS (threaded view), MMS(threaded view), Email | |

| Browser | HTML (Safari) | |

| Radio | No | |

| Games | Downloadable, incl. motion-based | |

| Colors | Black(8/16 GB), White (16 GB) | |

| GPS | Yes, with A-GPS support | |

| Java | No | |

| - Google Maps - Audio/video player - TV-out |

| Battery | Standard battery, Li-Ion | |

|---|---|---|

| Stand-by | Up to 300 h | |

| Talk time | Up to 10 h | |

| Music play | Up to 24 h |

| Misc | SAR US | 0.52 W/kg (head) 1.29 W/kg (body) |

|---|---|---|

| SAR EU | 0.56 W/kg (head) 0.23 W/kg (body) |

Labels:

Mobiles

Apple iPhone 3GS

;

Apple iPhone 3GS

Features

| General | 2G Network | GSM 850 / 900 / 1800 / 1900 |

|---|---|---|

| 3G Network | HSDPA 850 / 1900 / 2100 | |

| Announced | 2009, June | |

| Status | Available. Released 2009, June |

| Size | Dimensions | 115.5 x 62.1 x 12.3 mm |

|---|---|---|

| Weight | 135 g |

| Display | Type | TFT capacitive touchscreen, 16M colors |

|---|---|---|

| Size | 320 x 480 pixels, 3.5 inches | |

| - Scratch-resistant oleophobic surface - Multi-touch input method - Accelerometer sensor for auto-rotate - Proximity sensor for auto turn-off |

| Sound | Alert types | Vibration; Downloadable polyphonic, MP3 ringtones |

|---|---|---|

| Loudspeaker | Yes | |

| 3.5mm jack | Yes, check quality |

| Memory | Phonebook | Practically unlimited entries and fields, Photocall |

|---|---|---|

| Call records | 100 received, dialed and missed calls | |

| Internal | 8/16/32 GB storage, 256 MB RAM | |

| Card slot | No |

| Data | GPRS | Yes |

|---|---|---|

| EDGE | Yes | |

| 3G | HSDPA, 7.2 Mbps | |

| WLAN | Wi-Fi 802.11b/g | |

| Bluetooth | Yes, v2.1 with A2DP, headset support only | |

| Infrared port | No | |

| USB | Yes, v2.0 |

| Camera | Primary | 3.15 MP, 2048x1536 pixels, autofocus, check quality |

|---|---|---|

| Features | Touch focus, geo-tagging | |

| Video | Yes, VGA@30fps, video geo-tagging | |

| Secondary | No |

| Features | OS | iPhone OS 3, upgradable to iOS 4 |

|---|---|---|

| CPU | 600 MHz ARM Cortex A8 processor, PowerVR SGX535 GPU | |

| Messaging | SMS (threaded view), MMS, Email | |

| Browser | HTML (Safari) | |

| Radio | No | |

| Games | Downloadable, incl. motion-based | |

| Colors | Black, White | |

| GPS | Yes, with A-GPS support | |

| Java | No | |

| - Digital compass - Google Maps - Audio/video player - TV-out - Voice command/dial |

| Battery | Standard battery, Li-Ion | |

|---|---|---|

| Stand-by | Up to 300 h | |

| Talk time | Up to 12 h (2G) / Up to 5 h (3G) | |

| Music play | Up to 30 h |

| Misc | SAR US | 0.26 W/kg (head) 0.79 W/kg (body) |

|---|---|---|

| SAR EU | 0.45 W/kg (head) 0.40 W/kg (body) |

Labels:

Mobiles

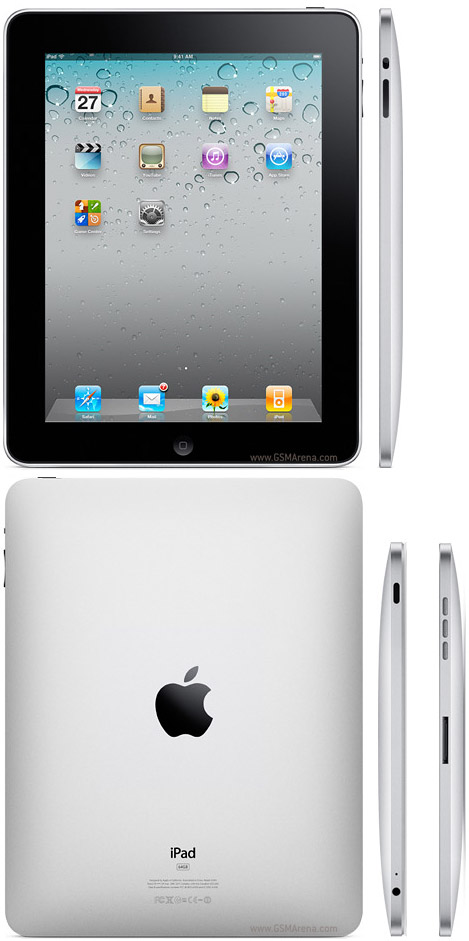

Apple iPad Wi-Fi

;

Apple iPad Wi-Fi

Features

| General | 2G Network | N/A |

|---|---|---|

| Announced | 2010, January | |

| Status | Available. Released 2010, March |

| Size | Dimensions | 242.8 x 189.7 x 13.4 mm |

|---|---|---|

| Weight | 680 g |

| Display | Type | LED-backlit IPS TFT, capacitive touchscreen, 16M colors |

|---|---|---|

| Size | 768 x 1024 pixels, 9.7 inches | |

| - Fingerprint/scratch resistant oleophobic surface - Multi-touch input method - Accelerometer sensor for auto-rotate |

| Sound | Alert types | N/A |

|---|---|---|

| Loudspeaker | Yes | |

| 3.5mm jack | Yes |

| Memory | Phonebook | Practically unlimited entries and fields |

|---|---|---|

| Call records | N/A | |

| Internal | 16/32/64 GB storage, 256 MB RAM | |

| Card slot | No |

| Data | GPRS | No |

|---|---|---|

| EDGE | No | |

| 3G | No | |

| WLAN | Wi-Fi 802.11 a/b/g/n | |

| Bluetooth | Yes, v2.1 with A2DP, EDR | |

| Infrared port | No | |

| USB | Yes, v2.0 |

| Camera | No |

|---|

| Features | OS | iOS 4 |

|---|---|---|

| CPU | 1 GHz ARM Cortex-A8 processor, PowerVR SGX535GPU, Apple A4 chipset | |

| Messaging | Email, Push Email, IM | |

| Browser | HTML (Safari) | |

| Radio | No | |

| Games | Downloadable, incl. motion-based | |

| Colors | Silver | |

| GPS | No | |

| Java | No | |

| - MP4/MP3/WAV/AAC player - Up to 10h movie playback - iBooks PDF reader - Google Maps - TV-out - Audio/video player |

| Battery | Standard battery, Li-Po | |

|---|---|---|

| Stand-by | ||

| Talk time |

Labels:

Mobiles

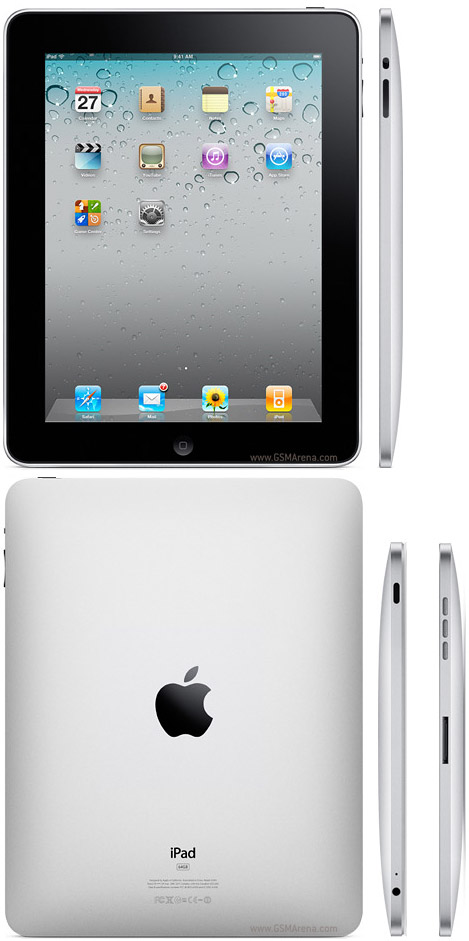

Apple iPad Wi-Fi + 3G

;

Apple iPad Wi-Fi + 3G

Features

| General | 2G Network | GSM 850 / 900 / 1800 / 1900 |

|---|---|---|

| 3G Network | HSDPA 850 / 1900 / 2100 | |

| Announced | 2010, January | |

| Status | Available. Released 2010, March |

| Size | Dimensions | 242.8 x 189.7 x 13.4 mm |

|---|---|---|

| Weight | 730 g |

| Display | Type | LED-backlit IPS TFT, capacitive touchscreen, 16M colors |

|---|---|---|

| Size | 768 x 1024 pixels, 9.7 inches | |

| - Fingerprint/scratch resistant oleophobic surface - Multi-touch input method - Accelerometer sensor for auto-rotate |

| Sound | Alert types | N/A |

|---|---|---|

| Loudspeaker | Yes | |

| 3.5mm jack | Yes |

| Memory | Phonebook | Practically unlimited entries and fields |

|---|---|---|

| Call records | N/A | |

| Internal | 16/32/64 GB storage, 256 MB RAM | |

| Card slot | No |

| Data | GPRS | Yes |

|---|---|---|

| EDGE | Yes | |

| 3G | HSDPA, HSUPA | |

| WLAN | Wi-Fi 802.11 a/b/g/n | |

| Bluetooth | Yes, v2.1 with A2DP, EDR | |

| Infrared port | No | |

| USB | Yes, v2.0 |

| Camera | No |

|---|

| Features | OS | iOS 4 |

|---|---|---|

| CPU | 1 GHz ARM Cortex-A8 processor, PowerVR SGX535GPU, Apple A4 chipset | |

| Messaging | Email, Push Email, IM | |

| Browser | HTML (Safari) | |

| Radio | No | |

| Games | Downloadable, incl. motion-based | |

| Colors | Silver | |

| GPS | Yes, with A-GPS support | |

| Java | No | |

| - MicroSIM card support only - Digital compass - MP4/MP3/WAV/AAC player - Up to 10h movie playback - iBooks PDF reader - Google Maps - TV-out - Audio/video player |

| Battery | Standard battery, Li-Po | |

|---|---|---|

| Stand-by | ||

| Talk time |

Labels:

Mobiles